If you're an Indian, then you must have watched or read Mahabharata in your life. It is a part of our antiquity. It's lessons has been passed down for generations and has changed the course of history.

There are many lessons to learn, but today I want to share five investing lessons from Mahabharata can teach you about investing.

Don't Invest in Something You Don't Understand

Shakuni is probably the villain in this story, but he leaves us with a lesson here. He helped Duryodhana beat the Pandavas at a dice game. The game may have been manipulated, but Yudhister- the oldest of the Pandavas- made an error when playing without fully understanding it. Moreover, he decided to bet on something that could be won or lost while playing - his wealth, kingdom and even his wife.

Yudhister did not know when to stop himself from gambling. He fell into what is called "the gambler's fallacy".

This simply says that if some event has happened more often than expected during a particular period, then it will happen less often in future periods.

For example, if you toss a coin three times and all three times heads turn up, then you might think on your next throw tails must come up. But unfortunately, you just fell into the trap because the probability of getting heads does not change based on past events.

Anyways, coming back to our point, I hope by now some very important investing lessons can be learned from Shakuni's actions: don't invest in something you don't understand.

Knowledge is Your Strongest Weapon

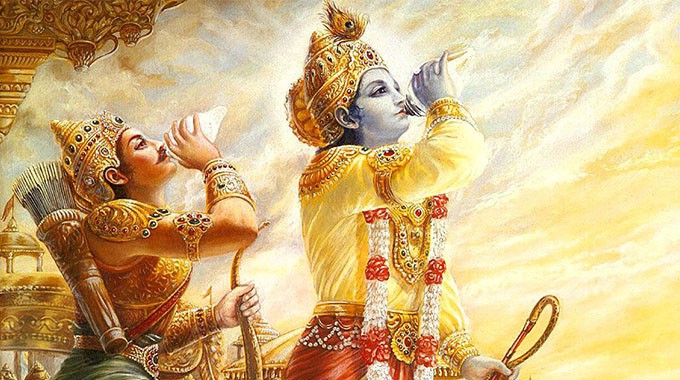

Arjuna, Bheema and Yudhisthra undertook a long hard journey to obtain Divyastras (divine wisdom) before the actual battle of Mahabharata, which helped them out in their most important time. Arjun continued to learn all his life. He learnt military science; Indra taught him divine weapons; Shiva taught him Pashupatastra and Krishna's guide throughout life.

When you learn more, you grow more and ultimately you achieve more.

Unfortunately, many people aren’t aware of the different investment options to secure and grow their earnings. In contrast, many investors have achieved their financial goals and created wealth by keeping themselves updated by reading and researching Mutual Funds or consulting a financial advisor.

Know Yourself Better

One of the most important questions Arjuna asks is if it's right to kill his family for dharma, righteousness.

Krishna replies that, in order to do something greater good, one must sacrifice something. Those who are sacrificed will only be the body. The soul never dies.

Your journey as an investor is also a journey where you can know yourself better by understanding your style-are you risk taker or conservative? What kind of investments do you enjoy making and why did you make such decisions?

Understanding this helps improve your knowledge about self and allows one not to be judged by others. Treat investing as a way to sharpen knowledge about oneself and invest with more confidence because there will always be someone else like us out there.

Do Not Follow Things Blindly

Historically, investments were not always a rational decision. Investors often acted out of panic or without thinking during market volatility, which led them to make bad decisions for their own portfolios.

One such example is Abhimanyu - son of Arjun and Subhadra - who entered the Chakravyuh alone with partial knowledge on how to enter it. He ended up getting killed because he didn't know how to exit when he reached that point in his journey through the maze-like structure Drona had designed.

In today's world, investing has become more accessible; however, one should never take risks during periods of market volatility without consulting an expert about their investment goals first. A financial advisor can help you keep your conviction even in times like these by counselling you with sound advice instead of getting pulled into something negative against your will due to uncertainty over what is happening in the markets right now.

Set Goals and Stick to Them

When Arjun was training to be a great warrior, he met his guru Dronacharya. He took the young princes to an open space where a wooden bird hung from a tree. The guru gave them the task of shooting the bird's eye from a long distance. When asked all the princes what they saw, everyone said they saw the bird, trees and feathers, but not Arjun.

All he saw were the bird's eye that had to be shot, and everything else became irrelevant for him because it pulled away from his concentration, which led to him successfully grabbing hold of victory.

This is how you should act if you want your financial goals accomplished without losing their sight; identify them first before you do anything else. It would help if you ignored market theatrics, regardless of how much the noise is and how they try to coerce you into giving up.

As an investor, you should monitor their portfolios as deemed fit to stay updated and not panic during short-term volatilities.

Final Thoughts

The Mahabharata teaches us many lessons about life, but the most important one is that we need to control our emotions, stand by what's right, and fight for it. In real-life investing, this translates to setting clear financial goals, periodic asset allocation reviews and portfolio management.

In real-life investing and finances, this translates to setting clear financial goals, periodic asset allocation, and portfolio review, having a strategic plan to achieve your goals, exiting the markets without risking your hard-earned gains, and not falling for past performances of mutual funds these are some of the key learnings from Mahabharata that will help you save more money on your long-term investments and feel more confident about becoming completely self-reliant and empowered.